• Save up one year's worth of expenses

• Keep fund in interest-bearing account

• Invest yearly interest from account into high-yield aggressive-growth stocks

• Continue every year until retirement

• Sell upon retirement and put into interest-bearing account

• Create cash flow with money based on expected age of death

• Use the annuity to augment retirement savings

Example:

• One year's expenses: $25,000

• Kept in money market account: 4%

• Yearly interest earned: $1,000

• Invested in stocks averaging 18%

• Age of beginning investment: 30

• Age of retirement: 65

Amount earned at age 65: $1,816,652

• Invested at 4.5% in money market account

• Two options

1) Create a perpetuity

⁃ Money ($1,816,652) is invested at 4.5% and the yearly interest ($81,749) is drawn out at the end of the year to supplement next year's retirement income. Invested in a separate money market account (at 4%) for general retirement income. Assuming biweekly payments, this method earns you an extra $3,209.93 every two weeks to supplement the primary retirement savings. This creates a near-guaranteed supplemental income for the remainder of the person's life.

2) Create an annuity

⁃ This method requires an assumption of the length of investor's life. Calculations are based on retirement at age 65 and death at age 100. Money ($1,816,652) is invested at the same 4.5% (no need to transfer the supplemental money to the primary money market account) earning a biweekly annuity payment of $3,966.40 until age 100.

Comparisons: Biweekly Payment: Remaining Amount at Age 100:

• Perpetuity $3,209.93 $1,816,652

• Annuity $3,966.40 ø

-Difference $756.47 $1,816,652

Friday, November 21, 2008

Wednesday, November 5, 2008

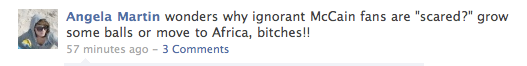

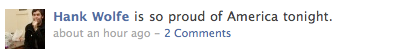

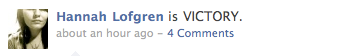

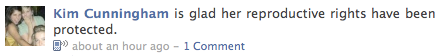

What my facebook friends think about Obama's victory.

It's cute how people can have so much faith in someone so inexperienced and full of rhetoric.

So, in honor of Obama's nomination, I give you the Ten Cannots William J. H. Boetcker.

"You cannot bring about prosperity by discouraging thrift.

You cannot strengthen the weak by weakening the strong.

You cannot help the poor man by destroying the rich.

You cannot further the brotherhood of man by inciting class hatred.

You cannot build character and courage by taking away man's initiative and independence.

You cannot help small men by tearing down big men.

You cannot lift the wage earner by pulling down the wage payer.

You cannot keep out of trouble by spending more than your income.

You cannot establish security on borrowed money.

You cannot help men permanently by doing for them what they will not do for themselves."

Words of wisdom.

It amazes me how swayed people are by empty rhetoric about hope and change and not by policy, experience, and most of all common sense.

Common sense is a great thing. Too bad our country lacks it. More on that in another post.

Monday, September 29, 2008

Great explanation of the causes of the financial crisis.

I'm a devoted follower of Jason Kearney's blog, Out Here In the Middle. He recently posted a great entry about the big causes of this crisis we have going on these days.

Sunday, September 21, 2008

Social Security.

Obama and McCain are both jackasses. This much is known. But Obama has been caught acting a damn fool again.

"Obama Criticizes McCain on Social Security

DAYTONA BEACH, Fla. — Senator Barack Obama delivered an ominous warning to Florida voters on Saturday, suggesting that Senator John McCain would “gamble with your life savings” by investing Social Security money in private accounts that could be affected by the roiling financial markets.

While Mr. McCain has not called for a full privatization of Social Security, he has supported the concept of allowing individuals to invest part of their payroll taxes in stock and bonds, and he has pledged to consider all options to prevent the program from going insolvent. But the idea has taken on a new air of political vulnerability because of the upheaval on Wall Street, which Mr. Obama sought to seize on as his campaign intensified its efforts in Florida.

“If my opponent had his way, the millions of Floridians who rely on it would’ve had their Social Security tied up in the stock market this week,” Mr. Obama told an audience here. “How do you think that would have made folks feel? Millions would’ve watched as the market tumbled and their nest egg disappeared before their eyes.”"

Let me tell you what Social Security privatization is. It would allow everyone who has a stake in the SS retirement system, i.e. everyone who has a job and pays into it, to control where it goes. Right now SS is invested in government bonds that pay 3.5%. Inflation is around 4%. Is the absurdity of this system showing up yet? The SS trust isn't even matching inflation.

So here's what we do. Either let young people like you and me opt out of the system (not pay anything in, not get anything out later), or let us control where the money that we pay in goes. It's all about personal freedom (something the left likes to think they support more than the right). If you want the old guaranteed way you can still choose to have your funds invested in the same government bonds. If you want something with a higher yield then you get to choose something with a higher yield. There are great mutual funds out there paying over 10% with minimal risk.

But I'll leave you with these facts: Ss is invested at 3.5%, inflation runs around 4%, and the stock market has averaged a little under 11% since its creation. That's an overall average, and yes, there are peaks and valleys. It loses money 1 out of every 4 years, but the overall average is almost 11%.

So tell me what's so horrible about people having a choice how their money is spent?

"Obama Criticizes McCain on Social Security

DAYTONA BEACH, Fla. — Senator Barack Obama delivered an ominous warning to Florida voters on Saturday, suggesting that Senator John McCain would “gamble with your life savings” by investing Social Security money in private accounts that could be affected by the roiling financial markets.

While Mr. McCain has not called for a full privatization of Social Security, he has supported the concept of allowing individuals to invest part of their payroll taxes in stock and bonds, and he has pledged to consider all options to prevent the program from going insolvent. But the idea has taken on a new air of political vulnerability because of the upheaval on Wall Street, which Mr. Obama sought to seize on as his campaign intensified its efforts in Florida.

“If my opponent had his way, the millions of Floridians who rely on it would’ve had their Social Security tied up in the stock market this week,” Mr. Obama told an audience here. “How do you think that would have made folks feel? Millions would’ve watched as the market tumbled and their nest egg disappeared before their eyes.”"

Let me tell you what Social Security privatization is. It would allow everyone who has a stake in the SS retirement system, i.e. everyone who has a job and pays into it, to control where it goes. Right now SS is invested in government bonds that pay 3.5%. Inflation is around 4%. Is the absurdity of this system showing up yet? The SS trust isn't even matching inflation.

So here's what we do. Either let young people like you and me opt out of the system (not pay anything in, not get anything out later), or let us control where the money that we pay in goes. It's all about personal freedom (something the left likes to think they support more than the right). If you want the old guaranteed way you can still choose to have your funds invested in the same government bonds. If you want something with a higher yield then you get to choose something with a higher yield. There are great mutual funds out there paying over 10% with minimal risk.

But I'll leave you with these facts: Ss is invested at 3.5%, inflation runs around 4%, and the stock market has averaged a little under 11% since its creation. That's an overall average, and yes, there are peaks and valleys. It loses money 1 out of every 4 years, but the overall average is almost 11%.

So tell me what's so horrible about people having a choice how their money is spent?

Saturday, September 20, 2008

Great article.

This is a great article written by Dave Ramsey.

Butt Scratching and Bass Fishing

"A couple of weeks ago, I worked late like I sometimes need to do to run my business. It was a nice Tennessee summer evening, and I was enjoying the drive home. About 7:30, as I pulled to a stop light a few blocks from my office, I noticed a light on in the corner office of a friend’s office building. Through the twilight I could make out my friend’s silhouette as he bent over his desk. Being a fellow entrepreneur, I knew what he was doing.

He was looking over some receivables. Some turkey hadn’t paid him, and he was trying to make his accounts balance so he would have the cash to make it another day. In that instant, I had a flashback to some of the ridiculous statements I’ve been hearing on the talking-head news channels and from some individuals during this political year. And I’ll be honest—I instantly felt the heat of anger flow through my body.

Let me tell you why. You see, my friend who I saw working late—we’ll call him Henry—is a great guy. He’s what you want your son to grow up to be. He loves God, his country, his wife, and his kids. He didn’t have the academic advantage of attending a big-name university. Instead, he started installing heating and air systems as a grunt laborer after he graduated from high school. He was and is a very hard and diligent worker, and before long, the boss taught him the trade. But when he was 24, after 6 years of service, the company he was working for got into financial trouble and laid him off.

Henry still had his tools, so he bought an old pickup to haul around his materials and tools, and suddenly he was in business. He knew about heating and air-conditioning, but not about business, so he made a lot of mistakes.

He persisted. He took accounting and management at the community college to learn about business. He started reading books on business, HVAC, marriage, kids, God, and anything else someone he respected recommended. Today he is one of the best-read men I know. Soon, because of his fabulous service and fair prices, he developed a great reputation, and his little business began to grow.

Henry started 15 years ago, and now he has 17 employees whose families are fed because he does a great job. He is in church on Sunday and seldom misses his kids’ Little League games. Sometimes he has to miss a game because some poor soul has their AC go out in the 96-degree Tennessee summer heat, but Henry makes sure they are served. He is, by all standards, a good man. He is, by all standards, what makes America great.

Henry and I are friends, and so he asked me some financial questions last year. I learned in the process that his personal taxable income last year was $328,000. I smiled with pride for this 70-hour a week guy because he is living the dream.

At the stop light that evening, I also thought of another guy I know—and that is where the anger flash came from. We will call him John. While John does not have the same drive Henry has, I can say that he, too, is a good man.

John also graduated from high school and did not attend a big-name university. He went to work at a local factory 15 years ago. When 5:00pm comes around, John has probably already made it to his car in the parking lot. He comes in 5 minutes late, takes frequent breaks, and leaves 5 minutes early. However, to his credit, he is steady and works hard.

Over the years, due to his steadiness and seniority, he has worked his way up to about $75,000 per year in that same factory. He seldom misses his kid’s ballgames, but most nights you will find him in front of the TV where he has become an expert on “American Idol,” “The Biggest Loser,” and who got thrown off the island. When he is not in front of the TV, he spends a LOT of time and money bass fishing on our local lake. He never works over 40 hours a week and hasn’t read a non-fiction book since high school.

This is America, and there is nothing wrong with either set of choices. Nothing wrong, that is, until the politicians and socialists get involved ...

I have seen several elitist people on the talking-head channels make the statement lately that people making over $250,000 per year have a “moral imperative” to pay more in taxes to take care of the country’s problems. This is not only infuriating—it is economically, spiritually, and morally crazy!

Where in the world do these twits get off saying that Henry should be punished for his diligence? If you are John, where do you get off trying to take Henry’s hard-earned money away from him in the name of your misguided “fairness”? If you want to sit on the lake, drink beer, scratch your butt, and bass fish, that is perfectly fine with me. I am not against any of those activities and have engaged in some of them myself at one time or another. But you HAVE NO RIGHT to talk about “moral imperatives” about what other people have earned due to their diligence. That money is not yours! You want some money? Go earn some! Get up, leave the cave, kill something, and drag it home.

We are in a dangerous place in our country today. A segment of our population has decided that it is the government’s job to provide all of their protection, provision, and prosperity. This segment has figured out that government doesn’t have the money to give them everything they want, so somebody else has to pay for it. That is how the “politics of envy” was born. “Tax the rich” has become the mantra of the left, and this political season it has been falsely dubbed a “moral imperative.”

Ninety percent of America’s millionaires are first-generation rich. They are Henry. To tax them because you think it is a “moral imperative” is legalizing governmental theft from our brightest, most charitable, and most productive citizens.

If I can get a law passed that says you must surrender all your cars to the government because it is the “moral imperative” of anyone who owns cars to support the latest governmental program, that would be a violation of private property rights and simply morally wrong. This new “moral imperative” to redistribute wealth is no different from that. It’s the SAME THING!

Please, America, re-think the politics of envy! You are sowing the seeds of our destruction when you punish the Henrys of our culture.

If you think taxing the populace to support government programs is the best way—and I don’t—then at least tax every single person the same! There are very few Henrys out here who would squawk much about paying a set percentage of their income—if everyone else did, too. But this idea of some butt-scratching bass fisherman saying government should tax his neighbor and not him—just because his neighbor has succeeded—must stop.

So the next time an elitist media talking-head starts telling you it is the moral imperative of our culture to tax my friend Henry, change the channel.

The next time you see someone wealthy who feels guilty and is preaching the politics of envy, change the channel.

The next time you see some celebrity who feels guilt over their income preaching socialism, change the channel.

And the next time you run into a misguided, butt-scratching bass fisherman who says the evil rich people in our culture should have their private property confiscated because that is fair… well just shake your head walk away—and make sure to vote against his candidate. If he and his type win, God help America."

Butt Scratching and Bass Fishing

"A couple of weeks ago, I worked late like I sometimes need to do to run my business. It was a nice Tennessee summer evening, and I was enjoying the drive home. About 7:30, as I pulled to a stop light a few blocks from my office, I noticed a light on in the corner office of a friend’s office building. Through the twilight I could make out my friend’s silhouette as he bent over his desk. Being a fellow entrepreneur, I knew what he was doing.

He was looking over some receivables. Some turkey hadn’t paid him, and he was trying to make his accounts balance so he would have the cash to make it another day. In that instant, I had a flashback to some of the ridiculous statements I’ve been hearing on the talking-head news channels and from some individuals during this political year. And I’ll be honest—I instantly felt the heat of anger flow through my body.

Let me tell you why. You see, my friend who I saw working late—we’ll call him Henry—is a great guy. He’s what you want your son to grow up to be. He loves God, his country, his wife, and his kids. He didn’t have the academic advantage of attending a big-name university. Instead, he started installing heating and air systems as a grunt laborer after he graduated from high school. He was and is a very hard and diligent worker, and before long, the boss taught him the trade. But when he was 24, after 6 years of service, the company he was working for got into financial trouble and laid him off.

Henry still had his tools, so he bought an old pickup to haul around his materials and tools, and suddenly he was in business. He knew about heating and air-conditioning, but not about business, so he made a lot of mistakes.

He persisted. He took accounting and management at the community college to learn about business. He started reading books on business, HVAC, marriage, kids, God, and anything else someone he respected recommended. Today he is one of the best-read men I know. Soon, because of his fabulous service and fair prices, he developed a great reputation, and his little business began to grow.

Henry started 15 years ago, and now he has 17 employees whose families are fed because he does a great job. He is in church on Sunday and seldom misses his kids’ Little League games. Sometimes he has to miss a game because some poor soul has their AC go out in the 96-degree Tennessee summer heat, but Henry makes sure they are served. He is, by all standards, a good man. He is, by all standards, what makes America great.

Henry and I are friends, and so he asked me some financial questions last year. I learned in the process that his personal taxable income last year was $328,000. I smiled with pride for this 70-hour a week guy because he is living the dream.

At the stop light that evening, I also thought of another guy I know—and that is where the anger flash came from. We will call him John. While John does not have the same drive Henry has, I can say that he, too, is a good man.

John also graduated from high school and did not attend a big-name university. He went to work at a local factory 15 years ago. When 5:00pm comes around, John has probably already made it to his car in the parking lot. He comes in 5 minutes late, takes frequent breaks, and leaves 5 minutes early. However, to his credit, he is steady and works hard.

Over the years, due to his steadiness and seniority, he has worked his way up to about $75,000 per year in that same factory. He seldom misses his kid’s ballgames, but most nights you will find him in front of the TV where he has become an expert on “American Idol,” “The Biggest Loser,” and who got thrown off the island. When he is not in front of the TV, he spends a LOT of time and money bass fishing on our local lake. He never works over 40 hours a week and hasn’t read a non-fiction book since high school.

This is America, and there is nothing wrong with either set of choices. Nothing wrong, that is, until the politicians and socialists get involved ...

I have seen several elitist people on the talking-head channels make the statement lately that people making over $250,000 per year have a “moral imperative” to pay more in taxes to take care of the country’s problems. This is not only infuriating—it is economically, spiritually, and morally crazy!

Where in the world do these twits get off saying that Henry should be punished for his diligence? If you are John, where do you get off trying to take Henry’s hard-earned money away from him in the name of your misguided “fairness”? If you want to sit on the lake, drink beer, scratch your butt, and bass fish, that is perfectly fine with me. I am not against any of those activities and have engaged in some of them myself at one time or another. But you HAVE NO RIGHT to talk about “moral imperatives” about what other people have earned due to their diligence. That money is not yours! You want some money? Go earn some! Get up, leave the cave, kill something, and drag it home.

We are in a dangerous place in our country today. A segment of our population has decided that it is the government’s job to provide all of their protection, provision, and prosperity. This segment has figured out that government doesn’t have the money to give them everything they want, so somebody else has to pay for it. That is how the “politics of envy” was born. “Tax the rich” has become the mantra of the left, and this political season it has been falsely dubbed a “moral imperative.”

Ninety percent of America’s millionaires are first-generation rich. They are Henry. To tax them because you think it is a “moral imperative” is legalizing governmental theft from our brightest, most charitable, and most productive citizens.

If I can get a law passed that says you must surrender all your cars to the government because it is the “moral imperative” of anyone who owns cars to support the latest governmental program, that would be a violation of private property rights and simply morally wrong. This new “moral imperative” to redistribute wealth is no different from that. It’s the SAME THING!

Please, America, re-think the politics of envy! You are sowing the seeds of our destruction when you punish the Henrys of our culture.

If you think taxing the populace to support government programs is the best way—and I don’t—then at least tax every single person the same! There are very few Henrys out here who would squawk much about paying a set percentage of their income—if everyone else did, too. But this idea of some butt-scratching bass fisherman saying government should tax his neighbor and not him—just because his neighbor has succeeded—must stop.

So the next time an elitist media talking-head starts telling you it is the moral imperative of our culture to tax my friend Henry, change the channel.

The next time you see someone wealthy who feels guilty and is preaching the politics of envy, change the channel.

The next time you see some celebrity who feels guilt over their income preaching socialism, change the channel.

And the next time you run into a misguided, butt-scratching bass fisherman who says the evil rich people in our culture should have their private property confiscated because that is fair… well just shake your head walk away—and make sure to vote against his candidate. If he and his type win, God help America."

Tuesday, September 16, 2008

Why mortgage tax breaks are bullshit.

I suppose I'm being too harsh. It's not the tax breaks that are bullshit, it's that people will hang on to their mortgage, paying only the minimum, because they think they're smart to "keep the tax break".

Say there's a person who has a good job paying $130,000 (28% tax bracket).

They get a house, put 20% down ($40,000) to avoid PMI, and puts the other $200,000 on a 30-year note at 6.5%.

The mortgage tax break comes in the form of interest deductions. For the amount of interest you pay to the bank in a given fiscal year, you'll get to deduct, or not pay taxes on that amount. In other words, the amount of interest is deducted from your overall earnings.

The interest they'll pay for the first year with this mortgage is $11,861.92. That means that they'll get to deduct $11,861.92 from their overall earnings for that year. With me so far?

Well, normally they'd pay $30,382 in taxes, ending up with $99,618 after federal income taxes.

But they get that tax break, right? So they get to deduct $11,861 from that original $130,000, which, in the 28% tax bracket, will end up saving them $3,321 in federal taxes.

So, because it's so smart to keep your mortgage for as long as you can for the tax break, this person will pay a bank $11,861 in order to avoid paying the government $3,321. Keep in mind that this figure doesn't include home owners insurance, home owners association dues, unexpected repairs, and local and state property taxes.

Does that sounds smart to you?

I mean, the tax break is a nice perk, but it's hardly worth not paying off your mortgage early if you have the means.

Say there's a person who has a good job paying $130,000 (28% tax bracket).

They get a house, put 20% down ($40,000) to avoid PMI, and puts the other $200,000 on a 30-year note at 6.5%.

The mortgage tax break comes in the form of interest deductions. For the amount of interest you pay to the bank in a given fiscal year, you'll get to deduct, or not pay taxes on that amount. In other words, the amount of interest is deducted from your overall earnings.

The interest they'll pay for the first year with this mortgage is $11,861.92. That means that they'll get to deduct $11,861.92 from their overall earnings for that year. With me so far?

Well, normally they'd pay $30,382 in taxes, ending up with $99,618 after federal income taxes.

But they get that tax break, right? So they get to deduct $11,861 from that original $130,000, which, in the 28% tax bracket, will end up saving them $3,321 in federal taxes.

So, because it's so smart to keep your mortgage for as long as you can for the tax break, this person will pay a bank $11,861 in order to avoid paying the government $3,321. Keep in mind that this figure doesn't include home owners insurance, home owners association dues, unexpected repairs, and local and state property taxes.

Does that sounds smart to you?

I mean, the tax break is a nice perk, but it's hardly worth not paying off your mortgage early if you have the means.

Thursday, September 4, 2008

Our great country needs change.

I'm not too far right to admit it. The United States needs change. The past 8 years have been atrocious, wasteful, and at points, very bad for our country as a whole. The national debt has doubled. We're running a huge budget deficit this year. The economy is so close to recession it could tickle it on the ass and make recession giggle with glee. Inflation is on the rise. Social security is going to go bankrupt. Our troops are too far stretched that if we really needed to defend ourselves on the home front we'd have to rely on the 5 national guardsmen that are still stateside and various state militias. The dollar's value is the lowest it's been in a long time. Peoples' incomes are being stretched more than ever. The price of food is up.

So what's a country to do? Well, it can elect change. That's a good choice.

So what can be changed?

The economy? The president doesn't control the economy. Not even close. He can influence it by signing new laws, but that's such a small influence it's not worth counting on. Even if he did, the economy doesn't need ANY HELP right now. The best thing we can do is leave it the hell alone. No more "economic stimulus packages", and no more believing everything that the big media says. I once heard a writer say "The media has correctly predicted 2 of the past 36 recessions." There's a lot of truth to that. The economic slowdown we're experiencing now isn't Bush's fault. Get over it.

How about the deficit? Yeah, this has got to change. But here's something that's going to blow your mind; the deficit can be solved without raising taxes. *gasp* I know, hard to think of, right? We should cut the federal budget in half. This would mean no more war, less wasteful spending, and (here's the hard one) decrease the amounts of entitlements given out. Entitlements are one of the biggest wasteful spending items, and one of the most abused. Another thing that needs to end is corporate welfare. It's estimated that the government loses $92 billion a year because of corporate welfare.

How about this social security problem? The baby boomers are going to be retiring en masse soon. Again, the easy fix is to raise taxes. Raise the payroll tax rate, get rid of the FICA income cap, and get that sweet dolla' rolling in. Obama of course has expressed interest in doing both of those things, although if memory serves me he's against raising the $102,000 cap, which is at least not too bad. Now for the real solution: We need to privatize social security. SS retirement benefits were never meant to provide and actual income to retired persons, it was meant to provide extra spending money so little old ladies could buy their hard candy. It was meant to argument a person's life savings. But for so many people it's a crutch. You know what I say? I say decrease benefits for the baby boomers. Decrease them by at least half. The baby boomers have known about this problem their entire lives, and they've done absolutely nothing to prevent it. Bush tried to do something in 2000 but special interests shut that plan down. They don't deserve the retirement benefits. They paid into the system, but they knew it was broken all along and did nothing, so now our generation is going to have to deal with the repercussions. Give me the form and I'll opt out of the SS retirement system. I'll be the first to sign my name, releasing the government from having to provide me anything during my retirement. I'll be the guinea pig, and I'll show people that you can provide for your own retirement (just like people did before Mother Government did in the 30's).

The troops? Bring 'em home. Iraq wants a timetable, so give it to them. I believe we already have one. 2011. That's good.

Inflation? Let's stop the Federal Reserve from inflating our money supply. When the "mortgage crisis" hit, they lowered interest rates and pumped money into the system. This decreased the value of the dollar, made it easy to get credit, and punished investors, including the elderly who are trying to provide steady income with CDs, money market accounts, and high-interest savings accounts. When the Fed lowered rates, my savings account rate went from 1.5% to .25%. We have a lot of money in a money market account and we're only getting 1.98%, when a year ago we would've been getting 4-5%. Lowering rates rewards debt and punishes investors.

Also, to clear something up, there was never a "mortgage crisis", there was a sub-prime mortgage crisis. There WAS NOT a rise in the number of foreclosures for traditional mortgages, just for sub-prime, adjustable-rate, straight from hell mortgages. The people being foreclosed on weren't all defenseless people 'just trying to make it, most were dumb shits who thought they could cash-flow a heavily leveraged investment property, or people who bought into the whole "house-flipping" fad. The rest of them were people who bought way too much house than they could afford. These people DID NOT deserve a bail-out.

So what's a country to do? Elect the hotshot first term senator who's barely on the Senate floor, will push a socialist agenda, raise taxes, increase spending and entitlements, and will almost certainly be picked as prom king? No, that would be awful for the country. So we should elect the elderly, forgetful, often be-frazzled veteran of Congress? Well, he's done a lot to fight wasteful government spending, but he still has many problems.

So, you probably could guess, I'll be voting for McCain, albeit begrudgingly.

But why am I voting for him? Tax policies.

I'm in college for one reason and one reason only: to make myself marketable enough to get a good job. You never go to college to make less money.

McCain wants to create an alternative flat tax system and let Americans choose which system to use (old or new) depending on which saves them the most money.

He wants to get rid of the AMT, which is sucking more and more money out of the middle-class every year.

He wants to lower the corporate income tax which will do much more to keep businesses here in our country than any of Obama's tax-breaks (remember how much I hate corporate welfare?).

He wants to keep the capital gains rates low, unlike Obama who wants to raise it, seemingly based on general principle since it's been proven that federal revenue goes down when the CG rates are raised. How does this affect you? When you start working and saving for retirement you'll feel the crunch of the CG tax.

Say you invest $10,000 and you're able to get 8% average for 15 years. You make extra payments into the investment every month to the tune of $200. At the end of the 15 years you'll have an investment worth $102,738. You would have paid in a total of $46,000, making your earned interest $56,738. If you're in the 28% tax-bracket you'll pay 15% of your investment's gain to the government (all in the name of 'fairness'). So you'll only end up with $94,227, losing out $8,510 to the government. Plus you have to factor in inflation, which is about 4% every year. If Obama is able to raise the capital gains tax to something around the short-term rate of 28%, you'll end up paying $15,886 to the government (because you make too much damn money you greedy capitalist pig). You'll only end up with $86,851, not including 4% inflation. Factor in inflation and you'll end up with about $61,541, which would make your overall earning for the investment around 2.27%, which is only slightly more than our shitty money market is doing.

He also wants to kill the estate tax, which after a 2010 hiatus will go back up to the old rate of the federal gov't taking 55% of all estates worth over $1,000,000, which will kill an ungodly amount of small business. (so if you have a large estate and you're about to die, hold off until 2010, but don't live into 2011).

He's definitely not a perfect candidate but I'm a fiscal voter and since Ron Paul dropped out, McCain gets my vote.

Obama 's only plan is to tax the rich. Which brings me to my next bitch-about-town: Why tax the rich? Yeah they can afford to pay more, but they shouldn't have to. It's not fair. It's not morally fair, it's not ethically fair, it creates a large disincentive to earn, and it's economically inefficient.

90% of American millionaires are first generation. That means they left the cave, killed it, and brought it home. They didn't have help from daddy, or daddy's contacts, they didn't have any special hand up, and a good portion of them came from poor households.

The average millionaire is a small business owner (keep in mind that most employers in America are small businesses), most drive cars that aren't flashy, but rather are a few years old and well-kept, and the vast majority live in very reasonable houses.

Did I mention that most already donate a substantial amount of their income?

Our country needs more self-reliance, without the false sense of entitlement and the 'gimme gimme' attitude. The progressive-left, welfare, and class warfare have turned us into a bunch of whiny babies. Redistribution of wealth is inefficient, and most importantly un-America.

Back to Obama's tax-policies.

It really is a shame. America was founded as a place of equality, where someone can come and make millions. We are the greatest country in the world, and "progressive" interest will stop at nothing to turn us into a quasi-European welfare state. Those are some pretty harsh words, but somebody has to say them.

Progr essive taxation does nothing but reinforce the thought that we're all different. The whole idea of progressive taxation is based on nothing more than fiscal jealousy. Supporters say that "everyone, despite how much they make, must have a tax burden that hits them as much as the bottom bracket is it". In other words, a person making $200,000 must be hit as hard by income taxes as a person making $15,000. That's hardly the reason why they support it (in America at least).

It's all about fiscal jealousy. The idea that "if I can't have it, no one can". It's an asinine thought process. The liberal, democrats, and so called progressives can't stand that some people make more money than other people. But that's not even the real reason, or at least the main one. All the progressives that are hawking the idea of a European-esque socialist utopia are just doing it for the votes. Who do you think there are more of, the wealthy or the poor? Who do you think is going to rely on Mother Government more, the wealthy or the poor? Who has the greatest numbers at the polling booth, the wealthy or the poor?

I crack up when they point out that "the vast majority of the wealthy people either didn't work for their money or they had a tremendous amount of help from their daddy's connections." Never mind the fact that almost 90% of millionaires in the U.S. are first generation, meaning they built that wealth without daddy's help.

Wealth building takes a certain kind of person, and if you're not willing to control your habits you'll never build wealth. The typical millionaire drives a 3-4 year-old car, invests, has a good amount of self-discipline, has a household budget, they didn't get rich quick, they don't gamble or play the lottery, and they don't buy mansions that could hold 303 elephants.

People who are jealous about not being rich are usually the ones who play the lottery, buy as much house as they can barely afford, buy new cars every 3 years, and go out to eat way too often to show people that they have money. Most actual millionaires aren't concerned about letting people know about their wealth.

Speaking of un-American acts, let's talk about the oil companies.

Take, for example, Obama's plan for a windfall profits tax on the largest domestic oil companies. Ask your parents how that whole idea went down in the 70's. He also bitches about the subsidies (Which I'm also against, but for a much different reason. We wouldn't need subsidies if we lowered our horrendously high corporate income tax rate). The argument about the oil company tax breaks is such a nonsensical argument on his part. If he thinks that taking away tax subsidies is going to lower prices for consumers then he needs to go back to college and take a couple of economic courses.

The oil companies aren't making out like bandits like everyone seems to think they are. There profit margin is fairly low for as large of a business as it is. Exxon Mobile posted the biggest profit ever made in the history of man last quarter. The left see it as too much, but nobody seems to realize that Exxon Mobile is the largest company on the planet, dwarfing even Wal-Mart (which is the second largest).

It's also important to realize that only about 1% of domestic oil company stock is owned by their rich CEOs. Roughly 50% of domestic oil companies stock is owned by individual investors (i.e., people like me who invest on Scottrade because we know the government isn't going to take care of our retirement, nor do we want it to). The other roughly 40-49% of oil stock in America resides in 401(k)s and pension funds. These are the same 401(k)s and pensions that millions and millions of Americans are relying on for their retirement, including teachers, firemen, and police officers.

Taking away from oil companies' bottom lines will drive gas prices up and drive their stock prices down, along with million of American's retirements. If one was twisted enough one might conclude that Barack Obama is wanting to make people more reliant on government help by reducing peoples' individual retirements. I don't buy into this, but I've heard people say similar things.

Anywho, Obama's plan is a horrible one. But I think most importantly, it goes against everything America was created for. In socialist-Europe it may be okay for the governments to dictate what a "reasonable profit" for companies to make is, but America was founded by brilliant men on capitalist principles. Windfall profit taxes are un-American and will raise prices for the consumer.

What about Obama's federal income tax plan? Well, it's going to indirectly increase the tax burden on the middle-class.

"But Michael, Obama's plan will LOWER taxes for 95% of Americans!!! You don't know what you're talking about!"

An Obama presidency would be HORRIBLE for the middle-class.

Sure, his tax plan lowers FEDERAL INCOME TAXES for middle-class earners, but the effects of his tax plan will create many tax-increases in other areas. He's expressed interest in raising the gas tax, energy taxes, a quasi-tax on the American people in the form of higher gas prices caused by not drilling our reserves to their fullest potential, capital gains tax, FICA taxes, estate taxes, and income taxes...

The list goes on. So, yeah, the middle-class families who get the tax cuts will have to deal with all of these, effectively negating their tax cut.

There are many reasons why Barack Obama shouldn't be our next president, but I think the issue of our money and financial security are paramount.

Hope I rustled some feathers. It seems to anger people when I point out that Obama is not the Second Coming.

Cheerio.

So what's a country to do? Well, it can elect change. That's a good choice.

So what can be changed?

The economy? The president doesn't control the economy. Not even close. He can influence it by signing new laws, but that's such a small influence it's not worth counting on. Even if he did, the economy doesn't need ANY HELP right now. The best thing we can do is leave it the hell alone. No more "economic stimulus packages", and no more believing everything that the big media says. I once heard a writer say "The media has correctly predicted 2 of the past 36 recessions." There's a lot of truth to that. The economic slowdown we're experiencing now isn't Bush's fault. Get over it.

How about the deficit? Yeah, this has got to change. But here's something that's going to blow your mind; the deficit can be solved without raising taxes. *gasp* I know, hard to think of, right? We should cut the federal budget in half. This would mean no more war, less wasteful spending, and (here's the hard one) decrease the amounts of entitlements given out. Entitlements are one of the biggest wasteful spending items, and one of the most abused. Another thing that needs to end is corporate welfare. It's estimated that the government loses $92 billion a year because of corporate welfare.

How about this social security problem? The baby boomers are going to be retiring en masse soon. Again, the easy fix is to raise taxes. Raise the payroll tax rate, get rid of the FICA income cap, and get that sweet dolla' rolling in. Obama of course has expressed interest in doing both of those things, although if memory serves me he's against raising the $102,000 cap, which is at least not too bad. Now for the real solution: We need to privatize social security. SS retirement benefits were never meant to provide and actual income to retired persons, it was meant to provide extra spending money so little old ladies could buy their hard candy. It was meant to argument a person's life savings. But for so many people it's a crutch. You know what I say? I say decrease benefits for the baby boomers. Decrease them by at least half. The baby boomers have known about this problem their entire lives, and they've done absolutely nothing to prevent it. Bush tried to do something in 2000 but special interests shut that plan down. They don't deserve the retirement benefits. They paid into the system, but they knew it was broken all along and did nothing, so now our generation is going to have to deal with the repercussions. Give me the form and I'll opt out of the SS retirement system. I'll be the first to sign my name, releasing the government from having to provide me anything during my retirement. I'll be the guinea pig, and I'll show people that you can provide for your own retirement (just like people did before Mother Government did in the 30's).

The troops? Bring 'em home. Iraq wants a timetable, so give it to them. I believe we already have one. 2011. That's good.

Inflation? Let's stop the Federal Reserve from inflating our money supply. When the "mortgage crisis" hit, they lowered interest rates and pumped money into the system. This decreased the value of the dollar, made it easy to get credit, and punished investors, including the elderly who are trying to provide steady income with CDs, money market accounts, and high-interest savings accounts. When the Fed lowered rates, my savings account rate went from 1.5% to .25%. We have a lot of money in a money market account and we're only getting 1.98%, when a year ago we would've been getting 4-5%. Lowering rates rewards debt and punishes investors.

Also, to clear something up, there was never a "mortgage crisis", there was a sub-prime mortgage crisis. There WAS NOT a rise in the number of foreclosures for traditional mortgages, just for sub-prime, adjustable-rate, straight from hell mortgages. The people being foreclosed on weren't all defenseless people 'just trying to make it, most were dumb shits who thought they could cash-flow a heavily leveraged investment property, or people who bought into the whole "house-flipping" fad. The rest of them were people who bought way too much house than they could afford. These people DID NOT deserve a bail-out.

So what's a country to do? Elect the hotshot first term senator who's barely on the Senate floor, will push a socialist agenda, raise taxes, increase spending and entitlements, and will almost certainly be picked as prom king? No, that would be awful for the country. So we should elect the elderly, forgetful, often be-frazzled veteran of Congress? Well, he's done a lot to fight wasteful government spending, but he still has many problems.

So, you probably could guess, I'll be voting for McCain, albeit begrudgingly.

But why am I voting for him? Tax policies.

I'm in college for one reason and one reason only: to make myself marketable enough to get a good job. You never go to college to make less money.

McCain wants to create an alternative flat tax system and let Americans choose which system to use (old or new) depending on which saves them the most money.

He wants to get rid of the AMT, which is sucking more and more money out of the middle-class every year.

He wants to lower the corporate income tax which will do much more to keep businesses here in our country than any of Obama's tax-breaks (remember how much I hate corporate welfare?).

He wants to keep the capital gains rates low, unlike Obama who wants to raise it, seemingly based on general principle since it's been proven that federal revenue goes down when the CG rates are raised. How does this affect you? When you start working and saving for retirement you'll feel the crunch of the CG tax.

Say you invest $10,000 and you're able to get 8% average for 15 years. You make extra payments into the investment every month to the tune of $200. At the end of the 15 years you'll have an investment worth $102,738. You would have paid in a total of $46,000, making your earned interest $56,738. If you're in the 28% tax-bracket you'll pay 15% of your investment's gain to the government (all in the name of 'fairness'). So you'll only end up with $94,227, losing out $8,510 to the government. Plus you have to factor in inflation, which is about 4% every year. If Obama is able to raise the capital gains tax to something around the short-term rate of 28%, you'll end up paying $15,886 to the government (because you make too much damn money you greedy capitalist pig). You'll only end up with $86,851, not including 4% inflation. Factor in inflation and you'll end up with about $61,541, which would make your overall earning for the investment around 2.27%, which is only slightly more than our shitty money market is doing.

He also wants to kill the estate tax, which after a 2010 hiatus will go back up to the old rate of the federal gov't taking 55% of all estates worth over $1,000,000, which will kill an ungodly amount of small business. (so if you have a large estate and you're about to die, hold off until 2010, but don't live into 2011).

He's definitely not a perfect candidate but I'm a fiscal voter and since Ron Paul dropped out, McCain gets my vote.

Obama 's only plan is to tax the rich. Which brings me to my next bitch-about-town: Why tax the rich? Yeah they can afford to pay more, but they shouldn't have to. It's not fair. It's not morally fair, it's not ethically fair, it creates a large disincentive to earn, and it's economically inefficient.

90% of American millionaires are first generation. That means they left the cave, killed it, and brought it home. They didn't have help from daddy, or daddy's contacts, they didn't have any special hand up, and a good portion of them came from poor households.

The average millionaire is a small business owner (keep in mind that most employers in America are small businesses), most drive cars that aren't flashy, but rather are a few years old and well-kept, and the vast majority live in very reasonable houses.

Did I mention that most already donate a substantial amount of their income?

Our country needs more self-reliance, without the false sense of entitlement and the 'gimme gimme' attitude. The progressive-left, welfare, and class warfare have turned us into a bunch of whiny babies. Redistribution of wealth is inefficient, and most importantly un-America.

Back to Obama's tax-policies.

It really is a shame. America was founded as a place of equality, where someone can come and make millions. We are the greatest country in the world, and "progressive" interest will stop at nothing to turn us into a quasi-European welfare state. Those are some pretty harsh words, but somebody has to say them.

Progr essive taxation does nothing but reinforce the thought that we're all different. The whole idea of progressive taxation is based on nothing more than fiscal jealousy. Supporters say that "everyone, despite how much they make, must have a tax burden that hits them as much as the bottom bracket is it". In other words, a person making $200,000 must be hit as hard by income taxes as a person making $15,000. That's hardly the reason why they support it (in America at least).

It's all about fiscal jealousy. The idea that "if I can't have it, no one can". It's an asinine thought process. The liberal, democrats, and so called progressives can't stand that some people make more money than other people. But that's not even the real reason, or at least the main one. All the progressives that are hawking the idea of a European-esque socialist utopia are just doing it for the votes. Who do you think there are more of, the wealthy or the poor? Who do you think is going to rely on Mother Government more, the wealthy or the poor? Who has the greatest numbers at the polling booth, the wealthy or the poor?

I crack up when they point out that "the vast majority of the wealthy people either didn't work for their money or they had a tremendous amount of help from their daddy's connections." Never mind the fact that almost 90% of millionaires in the U.S. are first generation, meaning they built that wealth without daddy's help.

Wealth building takes a certain kind of person, and if you're not willing to control your habits you'll never build wealth. The typical millionaire drives a 3-4 year-old car, invests, has a good amount of self-discipline, has a household budget, they didn't get rich quick, they don't gamble or play the lottery, and they don't buy mansions that could hold 303 elephants.

People who are jealous about not being rich are usually the ones who play the lottery, buy as much house as they can barely afford, buy new cars every 3 years, and go out to eat way too often to show people that they have money. Most actual millionaires aren't concerned about letting people know about their wealth.

Speaking of un-American acts, let's talk about the oil companies.

Take, for example, Obama's plan for a windfall profits tax on the largest domestic oil companies. Ask your parents how that whole idea went down in the 70's. He also bitches about the subsidies (Which I'm also against, but for a much different reason. We wouldn't need subsidies if we lowered our horrendously high corporate income tax rate). The argument about the oil company tax breaks is such a nonsensical argument on his part. If he thinks that taking away tax subsidies is going to lower prices for consumers then he needs to go back to college and take a couple of economic courses.

The oil companies aren't making out like bandits like everyone seems to think they are. There profit margin is fairly low for as large of a business as it is. Exxon Mobile posted the biggest profit ever made in the history of man last quarter. The left see it as too much, but nobody seems to realize that Exxon Mobile is the largest company on the planet, dwarfing even Wal-Mart (which is the second largest).

It's also important to realize that only about 1% of domestic oil company stock is owned by their rich CEOs. Roughly 50% of domestic oil companies stock is owned by individual investors (i.e., people like me who invest on Scottrade because we know the government isn't going to take care of our retirement, nor do we want it to). The other roughly 40-49% of oil stock in America resides in 401(k)s and pension funds. These are the same 401(k)s and pensions that millions and millions of Americans are relying on for their retirement, including teachers, firemen, and police officers.

Taking away from oil companies' bottom lines will drive gas prices up and drive their stock prices down, along with million of American's retirements. If one was twisted enough one might conclude that Barack Obama is wanting to make people more reliant on government help by reducing peoples' individual retirements. I don't buy into this, but I've heard people say similar things.

Anywho, Obama's plan is a horrible one. But I think most importantly, it goes against everything America was created for. In socialist-Europe it may be okay for the governments to dictate what a "reasonable profit" for companies to make is, but America was founded by brilliant men on capitalist principles. Windfall profit taxes are un-American and will raise prices for the consumer.

What about Obama's federal income tax plan? Well, it's going to indirectly increase the tax burden on the middle-class.

"But Michael, Obama's plan will LOWER taxes for 95% of Americans!!! You don't know what you're talking about!"

An Obama presidency would be HORRIBLE for the middle-class.

Sure, his tax plan lowers FEDERAL INCOME TAXES for middle-class earners, but the effects of his tax plan will create many tax-increases in other areas. He's expressed interest in raising the gas tax, energy taxes, a quasi-tax on the American people in the form of higher gas prices caused by not drilling our reserves to their fullest potential, capital gains tax, FICA taxes, estate taxes, and income taxes...

The list goes on. So, yeah, the middle-class families who get the tax cuts will have to deal with all of these, effectively negating their tax cut.

There are many reasons why Barack Obama shouldn't be our next president, but I think the issue of our money and financial security are paramount.

Hope I rustled some feathers. It seems to anger people when I point out that Obama is not the Second Coming.

Cheerio.

Saturday, August 16, 2008

The importance of starting early.

This is a political blog, but I find that peoples' security is just as important as my whining about a certain Marxist Democratic candidate and a certain wimpy Republican candidate. I intend to show that you can retire in comfort without the help of Mother Government.

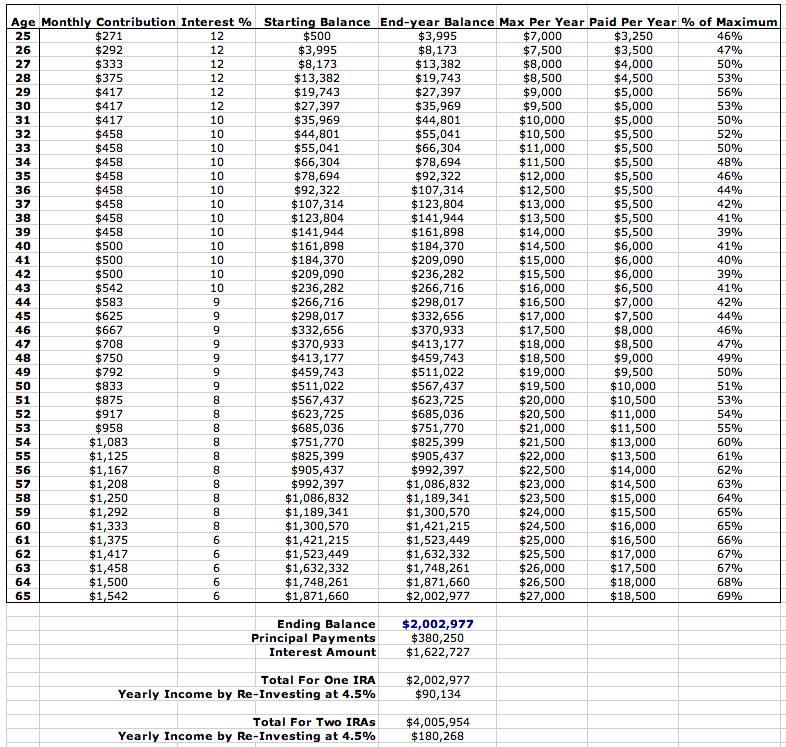

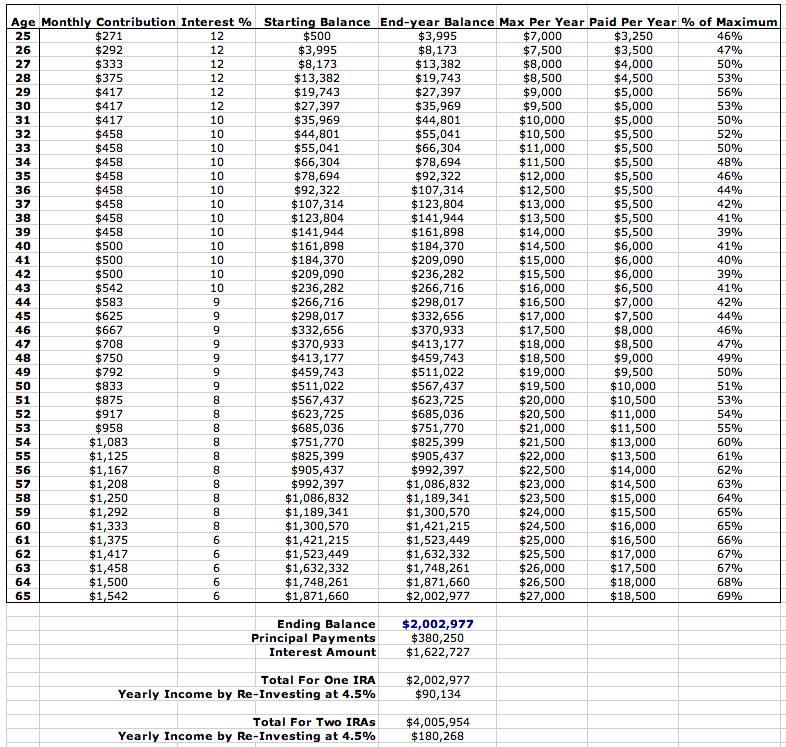

This is a spreadsheet about how much a Roth IRA can make you if you set it up correctly and have the self-control to actually save your money instead of blow it on stupid things.

This spreadsheet doesn't take into account that at age 50 you are able to save $1000 more per year than people below the age of 50. I was trying to make the scenario fairly conservative in its expectations. It als0 doesn't include other such investments that you'll undoubtedly make such as non-sheltered stocks and mutual funds and you're house's equity. It's also is very conservative in that normally a person around 50 years of age will be able to pay much more than $1500 into investments every month.

I know my pushiness about all things finance gets old, but if you want to retire in style (or at least moderate comfort) you'll need to start early and be diligent.

This is a spreadsheet about how much a Roth IRA can make you if you set it up correctly and have the self-control to actually save your money instead of blow it on stupid things.

This spreadsheet doesn't take into account that at age 50 you are able to save $1000 more per year than people below the age of 50. I was trying to make the scenario fairly conservative in its expectations. It als0 doesn't include other such investments that you'll undoubtedly make such as non-sheltered stocks and mutual funds and you're house's equity. It's also is very conservative in that normally a person around 50 years of age will be able to pay much more than $1500 into investments every month.

I know my pushiness about all things finance gets old, but if you want to retire in style (or at least moderate comfort) you'll need to start early and be diligent.

Sunday, June 1, 2008

Income inequality rising, and the bullshit that ensues.

I've been a devoted follower and cynic of the Progressive Intelligence and Opinion blog for many months now. There are many things that we disagree on, and a few things that agree on. This post is about one of the things we disagree on. Really disagree on. His new post, "Mindblowing inequality isn't just unfair but inefficient!"

(Never mind the fact that "mindblowing" isn't one word)

From what I've read about him he was born in the U.S., grew up in Germany, and moved back here, fully indoctrinated with that good ol' European socialist attitude.

He's had many-a post about the travesty of income inequality. With this blog, I'll show that not only are most claims of income inequality and wealth distribution grossly overstated, but that rich people being rich doesn't cause poor people to be poor. Imagine that.

Here are some income distribution facts from the U.S. Census Bureau.

Household Income Group % of Total Income Income Range

Lowest 20%------3.4%------$0-18,500

Second 20%------8.7%------$18,500-34,738

Third 20%--------14.7%-----$34,738-55,331

Fourth 20%------23.2%-----$55,331-88,030

Highest 20%-----50.1%-----$88,030 and up

The top 20% has roughly 14 times the total share of money than the bottom 20%. For a comparison, in 1971, the top 20% had only 11 times the share of total money than the bottom 20%.

But why is this? Is the same old saying "The rich get richer and the poor get poorer" true? Well, while a rich person has more money to invest (more on savings amounts later), and thus more of an opportunity to invest and earn more interest than someone at the bottom, income inequality has not risen by that much over the course of the 33 years in question.

The overstating of income inequality in our country is due in large part to two factors:

1. Measurements of inequality don't take into account in-kind transfers (medical assistance, food stamps, etc.).

2. The inequality expressed was taken from one point in time.

There are other things that come into play, such as immigrants and mindsets.

The steady increase in income inequality in recent decades is due largely to increased immigration. Between 1970 and 2000, foreign-born population in our great country increased from 9.6 million to 31.1 million. The percentage of the U.S. population that is foreign-born increased from 4.7% in 1970 to 11.1% in 2000.

Immigrants' median annual income is about 15% lower than native-born Americans. This is why the gap between the top and bottom groups has increased.

However, income is even more equally distributed after taking out taxes and in-kind (food stamps, medical assistance, etc.) transfer payments. The current measure of inequality is skewed by this lack of inclusion.

Higher incomes pay a higher percentage of their income in federal taxes, but in-kind transfers are received disproportionately by lower income households.

Another way that inequality is overstated is that the distribution of money income expressed above overstates the actual degree of income inequality by focusing on income distribution at one point in time.

A large chunk of the people in the lowest 20% of households are young people at the start of their careers. Most of these young people will move into higher income groups as their careers progress and they develop more human capital (developed ability that increases a person's productivity).

If career incomes were compared or if incomes were compared for households at the same career stage the gap between the highest and lowest would be much smaller.

Wealth distribution is also overstated. This is caused by the measure of wealth distribution comparing different people at different career stages. Comparing the wealth of a 60-year-old to the wealth of a 25-year-old overstates the inequality.

Wealth distribution is also overstated because human capital is NOT included in measuring wealth. For most people, their human capital is the most valuable asset owned. An example would be a 25-year-old recent Harvard Law School grad may have very little accumulated wealth in terms of physical assets, but the Harvard Law degree is very valuable human capital.

These are the causes of the continuing income inequality, which people might find interesting.

1. Natural ability: Some people are born with skills in math, music, or athletics. A person with a high level of marketable natural ability may earn a higher income than a person with a lower level of natural ability.

2. Human capital: Mean earning increase as education levels rise, but, again, a degree in chemical engineering and a degree in elementary education will have different earning potential in the marketplace.

3. Work and leisure choices: Contrary to popular belief rich people don't just sit back and make money off the backs of hardworking proletarians. Most people who've accumulated much wealth and have high earning potential have worked incredibly hard for it.

4. Risk taking: People differ in their willingness to take risks. An example would be that self-employed entrepreneurs make up a disproportionately large share of society's millionaires, but they also make up a disproportionately large share of those filling for bankruptcy.

5. Employment discrimination: This occurs when employees make hiring, promotion, and pay decisions based on factors unrelated to employee productivity.

6. Luck: A person can have good luck (winning the lottery) or bad luck (suffering a debilitating illness). Most people experience a mix of good and bad luck.

There will always be poverty, because honestly a lot of it has to do with how impoverished people think. They don't seek out wealth, but rather they tend to think that wealth shows up on its own. Wealth doesn't just come up and bite you on the butt, contrary to popular belief it seems.

Wealthy people aren't born trust fund babies 100% of the time; in fact it's quite the contrary. 90% of all millionaires in the U.S. are first generation, which means they left the cave, killed it, and brought it home. Their thought processes are different from people living in perpetual poverty. If you wants some more information about what the typical millionaire is really like check out Thomas J. Stanley's books The Millionaire Next Door and The Millionaire Mind.

Poverty isn't the fault of government and it's certainly not the fault of rich people. The majority of the problem rests with the people. The government and the already-wealthy are just easy targets.

The wealthy also differ in their savings rate. The average millionaire focuses on saving, investing, and building wealth, and not on spending their money on frivolous items. It is much easier for the wealthy to save money, as they need only save a small percentage of income rather than the larger chunk that must be saved by people with lesser incomes.

So again, don't buy into the fact that millionaires are automatically evil. Most are self-made, first generation, good-hearted people who live in modest houses, drive used cars, and take the time to learn about wise investing.

I'll leave you with this: Making rich people poorer doesn't make poor people richer.

So take your God damned socialism back to the Old World, buddy.

(Never mind the fact that "mindblowing" isn't one word)

From what I've read about him he was born in the U.S., grew up in Germany, and moved back here, fully indoctrinated with that good ol' European socialist attitude.

He's had many-a post about the travesty of income inequality. With this blog, I'll show that not only are most claims of income inequality and wealth distribution grossly overstated, but that rich people being rich doesn't cause poor people to be poor. Imagine that.

Here are some income distribution facts from the U.S. Census Bureau.

Household Income Group % of Total Income Income Range

Lowest 20%------3.4%------$0-18,500

Second 20%------8.7%------$18,500-34,738

Third 20%--------14.7%-----$34,738-55,331

Fourth 20%------23.2%-----$55,331-88,030

Highest 20%-----50.1%-----$88,030 and up

The top 20% has roughly 14 times the total share of money than the bottom 20%. For a comparison, in 1971, the top 20% had only 11 times the share of total money than the bottom 20%.

But why is this? Is the same old saying "The rich get richer and the poor get poorer" true? Well, while a rich person has more money to invest (more on savings amounts later), and thus more of an opportunity to invest and earn more interest than someone at the bottom, income inequality has not risen by that much over the course of the 33 years in question.

The overstating of income inequality in our country is due in large part to two factors:

1. Measurements of inequality don't take into account in-kind transfers (medical assistance, food stamps, etc.).

2. The inequality expressed was taken from one point in time.

There are other things that come into play, such as immigrants and mindsets.

The steady increase in income inequality in recent decades is due largely to increased immigration. Between 1970 and 2000, foreign-born population in our great country increased from 9.6 million to 31.1 million. The percentage of the U.S. population that is foreign-born increased from 4.7% in 1970 to 11.1% in 2000.

Immigrants' median annual income is about 15% lower than native-born Americans. This is why the gap between the top and bottom groups has increased.

However, income is even more equally distributed after taking out taxes and in-kind (food stamps, medical assistance, etc.) transfer payments. The current measure of inequality is skewed by this lack of inclusion.

Higher incomes pay a higher percentage of their income in federal taxes, but in-kind transfers are received disproportionately by lower income households.

Another way that inequality is overstated is that the distribution of money income expressed above overstates the actual degree of income inequality by focusing on income distribution at one point in time.

A large chunk of the people in the lowest 20% of households are young people at the start of their careers. Most of these young people will move into higher income groups as their careers progress and they develop more human capital (developed ability that increases a person's productivity).

If career incomes were compared or if incomes were compared for households at the same career stage the gap between the highest and lowest would be much smaller.

Wealth distribution is also overstated. This is caused by the measure of wealth distribution comparing different people at different career stages. Comparing the wealth of a 60-year-old to the wealth of a 25-year-old overstates the inequality.

Wealth distribution is also overstated because human capital is NOT included in measuring wealth. For most people, their human capital is the most valuable asset owned. An example would be a 25-year-old recent Harvard Law School grad may have very little accumulated wealth in terms of physical assets, but the Harvard Law degree is very valuable human capital.

These are the causes of the continuing income inequality, which people might find interesting.

1. Natural ability: Some people are born with skills in math, music, or athletics. A person with a high level of marketable natural ability may earn a higher income than a person with a lower level of natural ability.

2. Human capital: Mean earning increase as education levels rise, but, again, a degree in chemical engineering and a degree in elementary education will have different earning potential in the marketplace.

3. Work and leisure choices: Contrary to popular belief rich people don't just sit back and make money off the backs of hardworking proletarians. Most people who've accumulated much wealth and have high earning potential have worked incredibly hard for it.

4. Risk taking: People differ in their willingness to take risks. An example would be that self-employed entrepreneurs make up a disproportionately large share of society's millionaires, but they also make up a disproportionately large share of those filling for bankruptcy.

5. Employment discrimination: This occurs when employees make hiring, promotion, and pay decisions based on factors unrelated to employee productivity.

6. Luck: A person can have good luck (winning the lottery) or bad luck (suffering a debilitating illness). Most people experience a mix of good and bad luck.

There will always be poverty, because honestly a lot of it has to do with how impoverished people think. They don't seek out wealth, but rather they tend to think that wealth shows up on its own. Wealth doesn't just come up and bite you on the butt, contrary to popular belief it seems.

Wealthy people aren't born trust fund babies 100% of the time; in fact it's quite the contrary. 90% of all millionaires in the U.S. are first generation, which means they left the cave, killed it, and brought it home. Their thought processes are different from people living in perpetual poverty. If you wants some more information about what the typical millionaire is really like check out Thomas J. Stanley's books The Millionaire Next Door and The Millionaire Mind.

Poverty isn't the fault of government and it's certainly not the fault of rich people. The majority of the problem rests with the people. The government and the already-wealthy are just easy targets.

The wealthy also differ in their savings rate. The average millionaire focuses on saving, investing, and building wealth, and not on spending their money on frivolous items. It is much easier for the wealthy to save money, as they need only save a small percentage of income rather than the larger chunk that must be saved by people with lesser incomes.

So again, don't buy into the fact that millionaires are automatically evil. Most are self-made, first generation, good-hearted people who live in modest houses, drive used cars, and take the time to learn about wise investing.

I'll leave you with this: Making rich people poorer doesn't make poor people richer.

So take your God damned socialism back to the Old World, buddy.

Labels:

flat tax,

income inequality,

progressive tax,

tax system

Monday, April 14, 2008

Obama's Answer

A quickie here.

I'm watching CNN's "Compassion Forum" and Barack Obama and he was asked what he would do to reduce poverty in our great country.

Before he even opened his mouth I knew where he would go with his answer.

He talked briefly about the banking industry, but quickly went on to the tax code.

He talked about how people at the bottom pay too much and how George Bush's "tax cuts for the rich" were hurting the lower and middle classes. Now, for now we'll forget that Bush's tax cuts lowered not only the top rate from 39.5% to 35%, but also lowered the bottom rate from 15% to 10%.

Let's forget all of that for a second. How does giving people at the top tax cuts hurt poor people? Other than decreased government revenue, how is that directly affecting people at the bottom? It doesn't. The reason that tax breaks for the rich haven't worked in the past three decades was because the revenue cuts weren't met with cuts in government spending.

Let's just make this clear: Making the rich poorer does not make the poor richer.

I just had to get that off of my chest.

I'm watching CNN's "Compassion Forum" and Barack Obama and he was asked what he would do to reduce poverty in our great country.

Before he even opened his mouth I knew where he would go with his answer.

He talked briefly about the banking industry, but quickly went on to the tax code.

He talked about how people at the bottom pay too much and how George Bush's "tax cuts for the rich" were hurting the lower and middle classes. Now, for now we'll forget that Bush's tax cuts lowered not only the top rate from 39.5% to 35%, but also lowered the bottom rate from 15% to 10%.

Let's forget all of that for a second. How does giving people at the top tax cuts hurt poor people? Other than decreased government revenue, how is that directly affecting people at the bottom? It doesn't. The reason that tax breaks for the rich haven't worked in the past three decades was because the revenue cuts weren't met with cuts in government spending.

Let's just make this clear: Making the rich poorer does not make the poor richer.

I just had to get that off of my chest.

Wednesday, April 2, 2008

People make stupid decisions.

It's a fact of life that people are inevitably going to make stupid decisions. Kids do it, teens do it, adults do it, and seniors do it. Republicans do it, Democrats do it, Socialists do it (a lot),

and independents do it. Every race does it, every religion does it, every government does it, and every meteorologist does it. There is no way around making stupid decisions.

But the mistakes I'm talking about today were made by people who are on the news all the time and yet are never named. They are the people that are facing foreclosure because they got into a house they couldn't afford.

Now before I get the liberal smack down argument that the predatory mortgage lenders are at fault, let me say that I halfway agree. The mortgage companies are like a good portions of Americans; they think about the short term, not the long term.

The problem that many people are facing these days with their homes is a big one, and apparently one that the government thinks they need to solve. More on that later.

***Let me make it clear that the "crisis" only pertains to sub-prime mortgages. Foreclosures are up for people who borrowed sub-prime loans, but not for regular, traditional mortgages.***

I've heard many arguments about who's at fault for the sub-prime mortgage crisis. The lenders, the government, the Fed, and I've even heard the nation's rich people are to blame because they make the people who don't have as much money envy them.

Like I said above, the blame partially resides with the unethical lenders, who in order to make a quick buck lent money to people who couldn't afford the payments or the principal. But the main blame resides with the people who borrowed the money.

They weren't forced to borrow the money, they were just mislead by what we many call the "right" of all Americans to own homes.

Owning a home isn't a right in America, it's a privilege for those who earn it and can afford it.

We've become a nation of "gimmees" and takers. A good portion of the population it seems thinks that everything needs to be handed to them by the government and that rich people should foot the bill for their wants. I, of course, am completely against this way of thinking.

I don't see why people think that the government needs to intervene with everything. People think they need to stop the recession and that they need to stop the mass foreclosure. I just can't help but wonder why. Why is it the government's responsibility to help people that made stupid decisions? IT'S NOT! It's that simple.

I'm sure if you ask around you can find many people age 25 and older who got themselves into deep trouble and had their parents refuse to help them., and I guarantee you that whatever that experience was it made them stronger, more responsible, and more apt to deal with their problems themselves instead of relying on other people to bail them out. There should be more accountability with people that make stupid decisions.

I know it sounds mean, but people need to face the consequences of their actions, and if that involves losing their house and having to start from scratch then so be it. It will make them stronger, more appreciative of things they have, and much smarter about how they go about it the next time around.

I think that Americans' collective idea that we deserve everything is partially to blame for this problem of buying things we know we can't afford. That's why the average American has around $9,000 in unsecured credit card debt.

We Americans have lost sight of the old way of doing things. We used to buy frugally. We used to pay for things with cash only. Hell, people used to save up and buy houses with cash! Imagine how many people would make fun of you if you did that today.

"Well that's stupid! Why are you doing that? You'll lose your tax break! C'mon, lemme show you how it's done..."

America, here's a piece of advice that a very smart and responsible man once told me: Don't take money advice from broke people.